15+ Borrowing 60000

The reason why theres no exact. Assuming you have a 20 down payment 12000 your total mortgage on a 60000 home would be 48000.

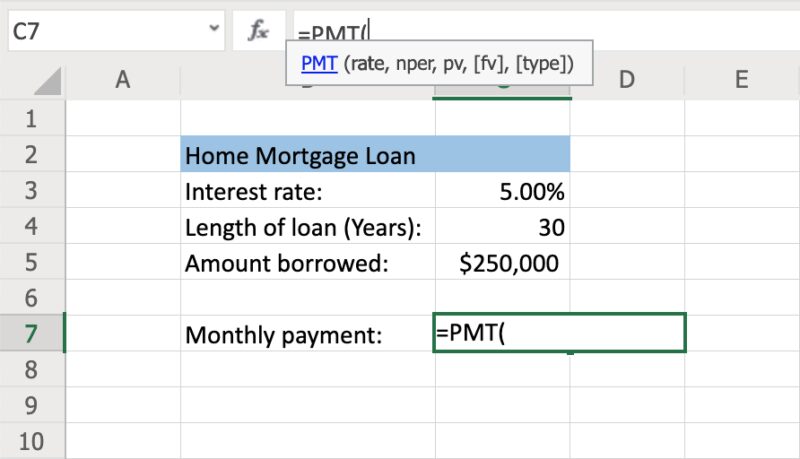

How To Calculate Monthly Loan Payments In Excel Investinganswers

5 Deposit Calculation for a.

. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Pay a higher downpayment or. The present interest rate for a 30 year mortgage is around 507.

Add taxes insurance and maintenance costs to estimate overall home ownership costs. This calculates the monthly payment of a 60k mortgage based on. Annual Percentage Rate the annual cost of borrowing or lending money.

This essentially means your lender has the right to repossess. 60000 Mortgages. When borrowing a sum of 60000 or more your lender will insist the loan be secured against a property.

See How Much You Can Save. 343 rows 15 Year 60000 Mortgage Loan. However there is some criteria in common between the majority of loan types including the following.

Payment Number Beginning Balance Interest Payment Principal Payment Ending Balance Cumulative Interest Cumulative Payments. Ad Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. This calculates the monthly payment of a 60k mortgage based on the amount.

10 Year 60000 Mortgage Loan. Just fill in the interest rate and the payment will be calculated automatically. Ad Low Interest 2022 Top Lenders Bad Credit Bank Loans Comparison Reviews.

Pay a higher downpayment or refinance to lower monthly payments. Rick Bormin Personal Loans Moderator. Thus the interest of the second year would come out to.

For a 30-year fixed mortgage with a 35 interest rate you would be looking. You have mentioned that your loan amount is 60000. You can borrow 60000 with bad credit from friends and family lenders that offer secured personal loans and pawnshops.

Just fill in the interest rate and the payment will be calculated automatically. 110 10 1. To borrow 60000 using a standard 25-year repayment mortgage with a 3 interest rate will cost 285 per month.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. A downpayment less than 20 often requires that the borrower purchase PMI. The eligibility criteria to borrow 60000 varies between lenders and loan products.

Add taxes insurance and maintenance costs to estimate overall home ownership costs. Your monthly mortgage payments would be. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Top-Rated Mortgage Companies 2022. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

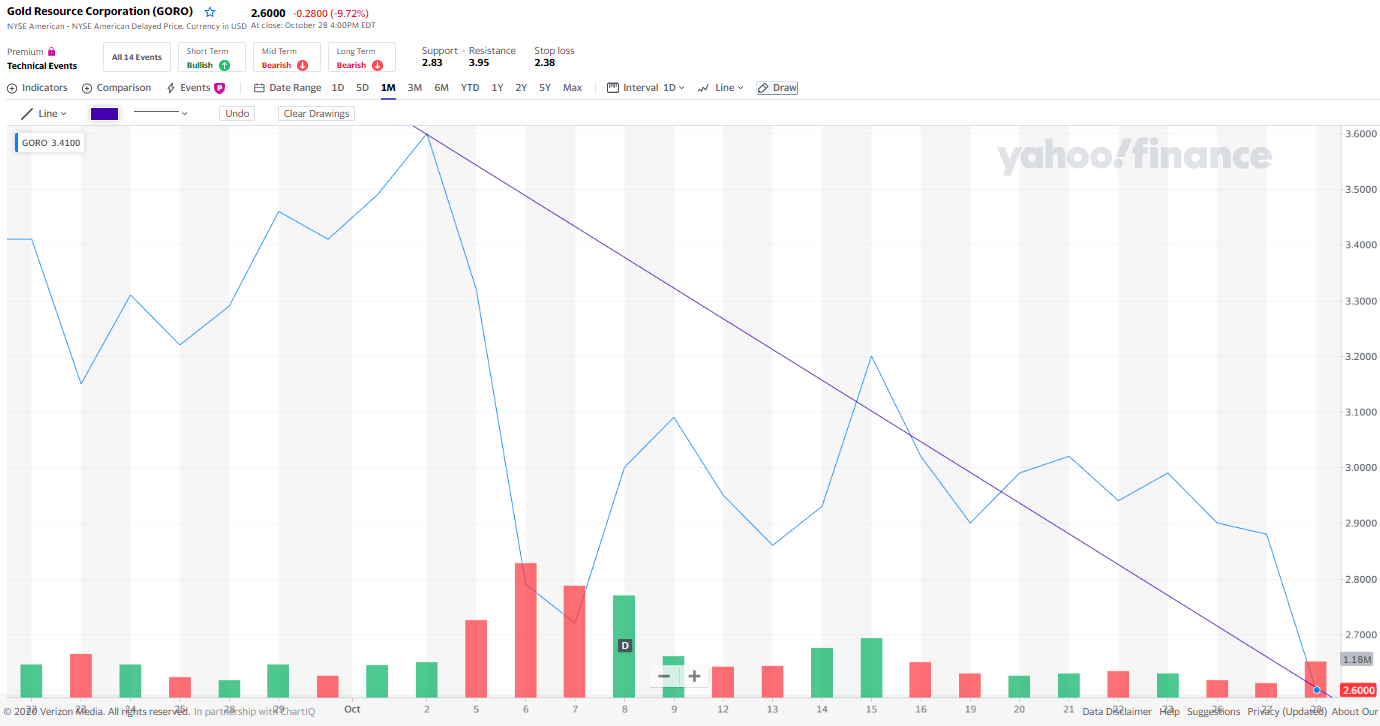

Gold Resource A Tale Of Two Mines Nyse Goro Seeking Alpha

2

Avah Ex99 1s36 Jpg

2

How To Calculate Emi On Bike Loan Quora

9 Best Credit Cards With Car Rental Insurance 2022

How Much Can I Borrow Home Loan Calculator

/business-with-customer-after-contract-signature-of-buying-house-957745706-c107ad59288c4de0b56d10315c08c67a.jpg)

How To Improve Your Chance Of Getting A Mortgage

2

Warhammer 40k One More Thing To Borrow From Age Of Sigmar Bell Of Lost Souls

How Much Can I Borrow Home Loan Calculator

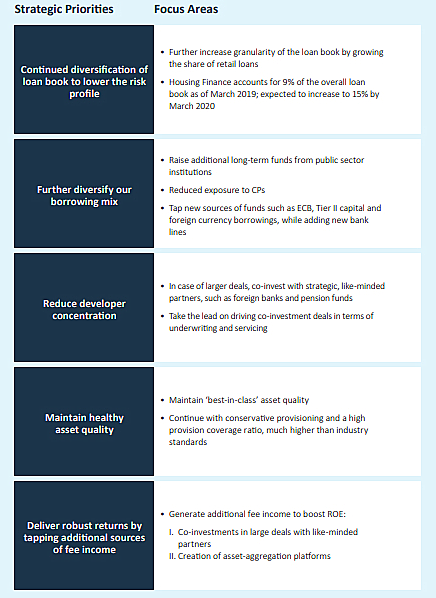

Piramal Enterprise Ltd Smart Sync Services

Loan Interest Calculator How Much Will I Pay In Interest

How Much Can I Borrow Home Loan Calculator

The Maths Doesn T Add Up For Buying A House In London Am I Missing Something R Ukpersonalfinance

2

Infographic Autism Spectrum Disorder Highlights From The Canadian Survey On Disability Canada Ca